Planned Giving  Planned Giving

Planned Giving

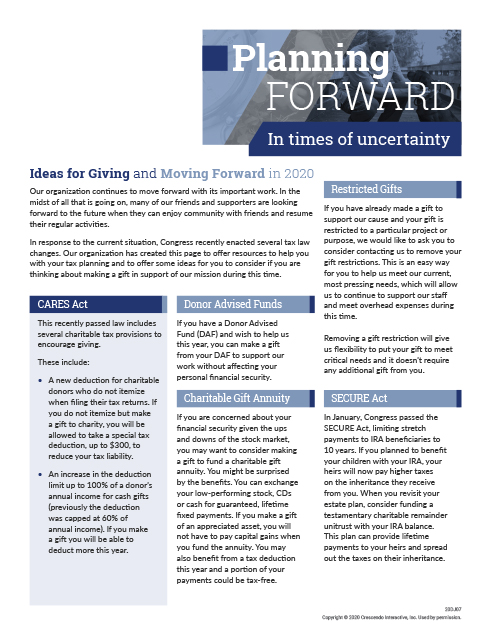

Ideas for Giving and Moving Forward

UC Santa Cruz continues to move forward with its important work. In the midst of all that is going on, many of our friends and supporters are looking forward to the future when they can enjoy community with friends and resume their regular activities. In response to the current situation, Congress recently enacted several tax law changes. UC Santa Cruz has created this page to help you with your tax planning and to offer some ideas for you to consider if you are thinking about making a gift in support of our mission of generating high impact research and our uncommon commitment to teaching and public service:

1. CARES ACT

This recently passed law includes several temporary charitable tax provisions to encourage giving. These include:

- A new deduction for charitable donors who do not itemize when filing their tax returns. If you do not itemize but make a cash gift to charity, you will be allowed to take a special tax deduction, up to $300 (per taxpayer unit), to reduce your tax liability.

- An increase in the deduction limit up to 100% of a donor's annual income for cash gifts (previously the deduction was capped at 60% of annual income). If you make a gift you will be able to deduct more this year.

2. SECURE Act

In December, 2019, Congress passed the SECURE Act, limiting stretch payments to IRA beneficiaries to 10 years. If you planned to benefit your children with your IRA, your heirs will now pay higher taxes on the inheritance they receive from you. When you revisit your estate plan, consider funding a testamentary charitable remainder unitrust with your IRA balance. This plan can provide lifetime payments to your heirs and spread out the taxes on their inheritance. There are exceptions for recipients with disabilities, minors and individuals within 10 years of the age of the IRA owner.

3. Donor Advised Funds

If you have a Donor Advised Fund (DAF) and wish to help us this year, you can make a gift from your DAF to support our work without affecting your personal financial security.

4. Charitable Gift Annuity

If you are concerned about your financial security given the ups and downs of the stock market, you may want to consider making a gift to fund a charitable gift annuity. You might be surprised by the benefits. You can exchange your low-performing stock, CDs or cash for guaranteed, lifetime fixed payments. If you make a gift of an appreciated asset, you will not have to pay capital gains when you fund the annuity. You may also benefit from a tax deduction this year and a portion of your payments could be tax-free.

5. Retirement Plan Assets

Donating part or all of your unused retirement assets, such as your IRA, 401(k), 403(b), pension or other tax-deferred plan, is an excellent way to make a gift to UC Santa Cruz. If you are like most people, you probably will not use all of your retirement assets during your lifetime. You can make a gift of your unused retirement assets to help further our mission.

- Individual Retirement Accounts (IRA) Rollover Program also known as a Qualified Charitable Distributions (QCD): IRA owners, age 70 ½ and older, may give up to $105,000 a year directly to charity to avoid being taxed on the income. Please note that QCDs do not qualify for a charitable deduction.

- Beneficiary designation: To leave your retirement assets to UC Santa Cruz, you will need to complete a beneficiary designation form provided by your retirement plan custodian. If you designate UC Santa Cruz as beneficiary, we will benefit from the full value of your gift because your IRA assets will not be taxed at your death. Your estate will benefit from an estate tax charitable deduction for the gift.

If you are interested in learning more about any of these ideas, please contact us.